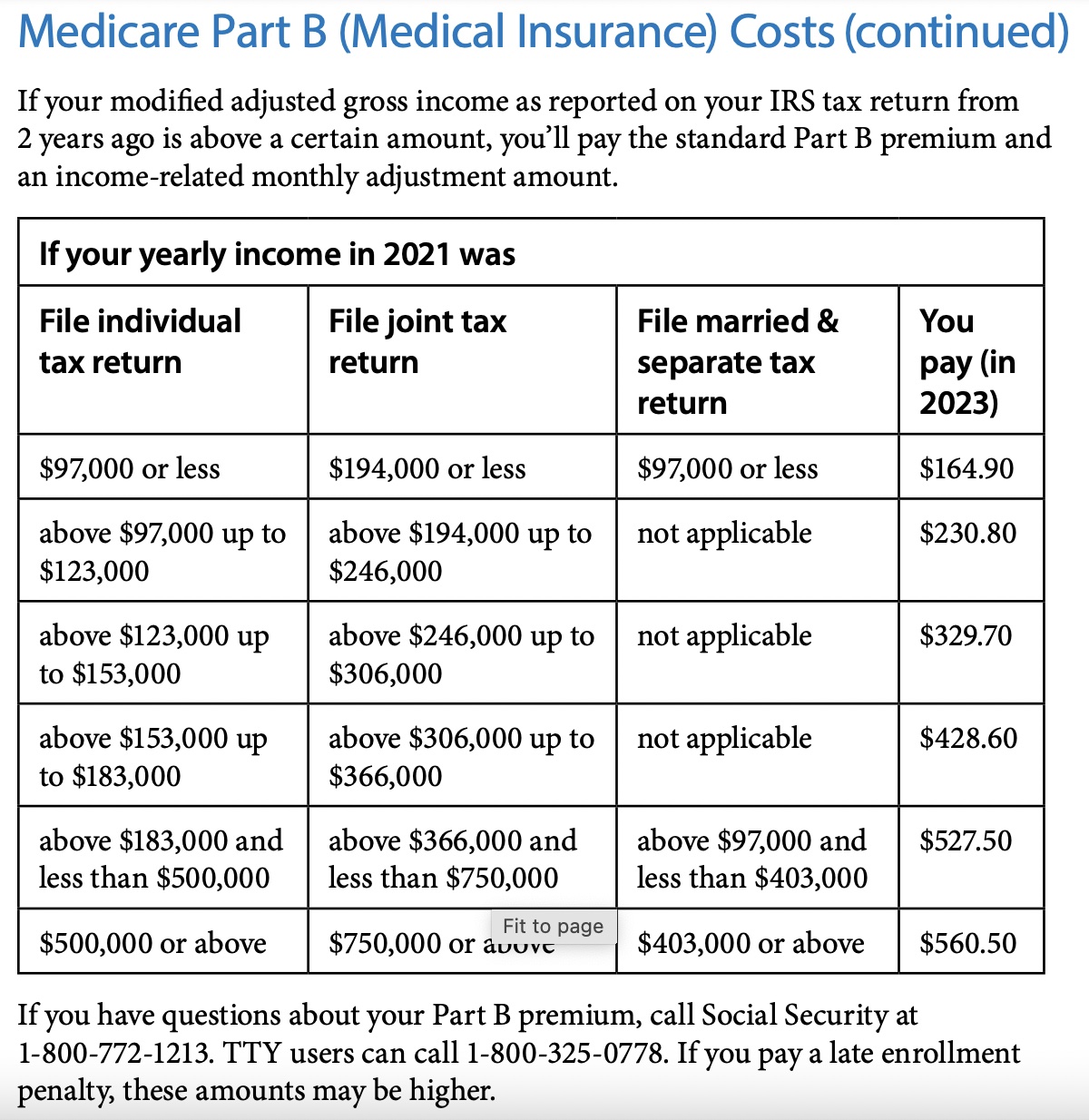

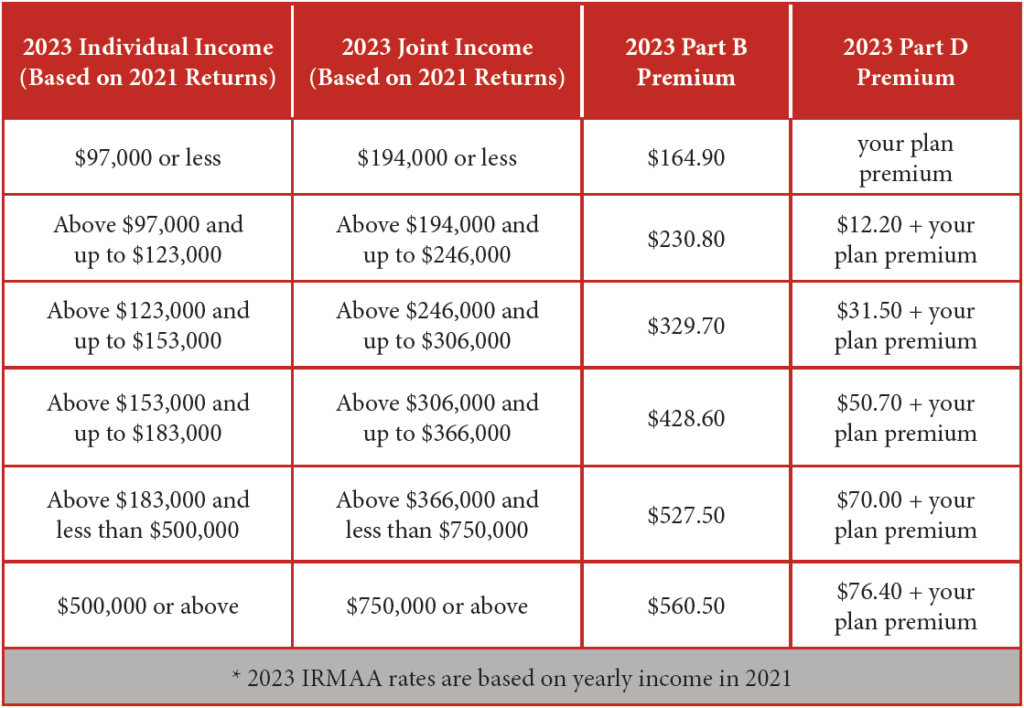

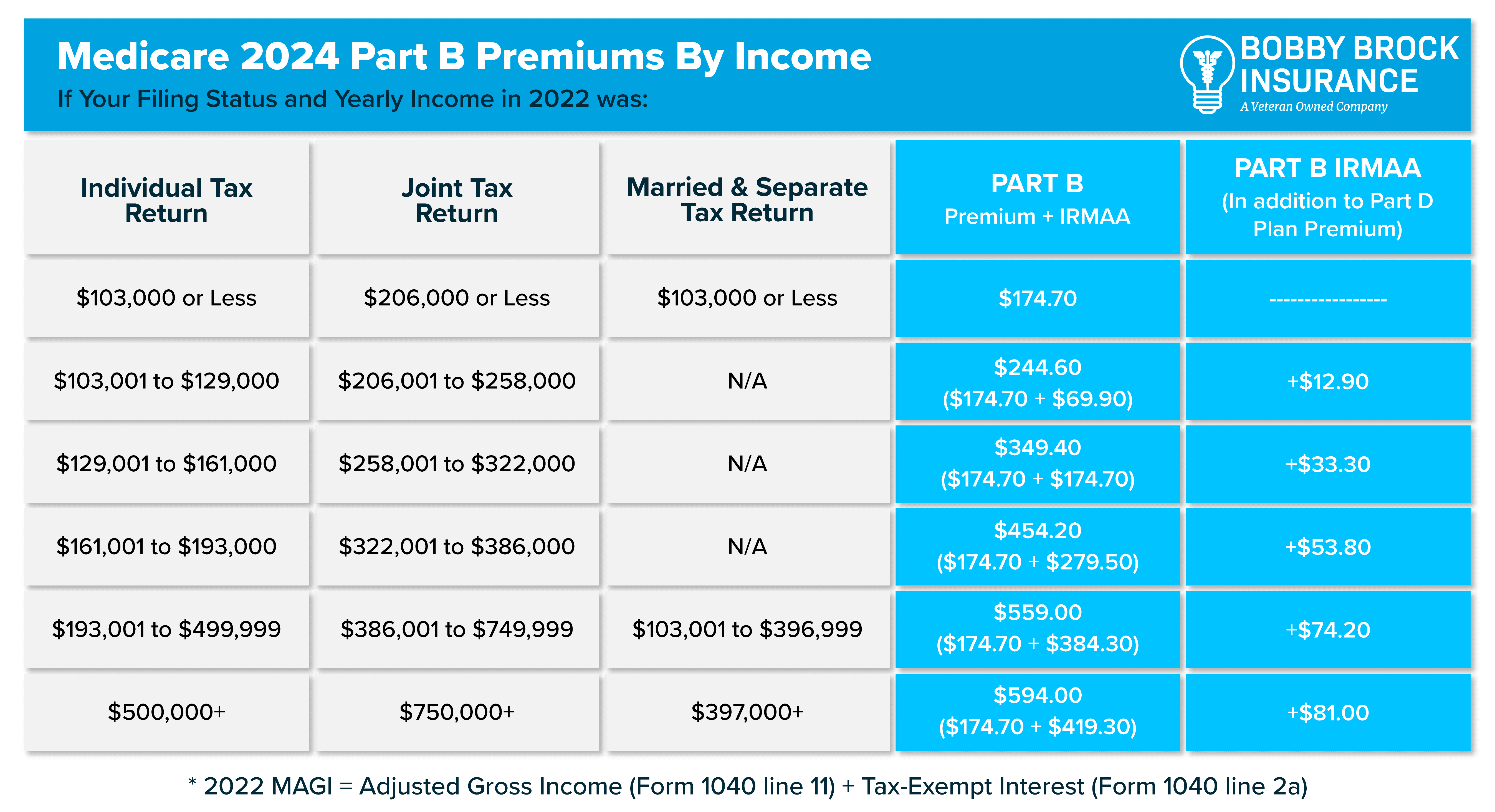

Irmaa Rates For 2025. Better yield than broad market bond etfs of similar. For 2025, beneficiaries whose 2025 income exceeded $103,000 (individual return) or $206,000 (joint return) pay a total premium amount ranging from $244.60 to $594.

For 2025, beneficiaries whose 2025 income exceeded $103,000 (individual return) or $206,000 (joint return) pay a total premium amount ranging from $244.60 to $594. In this comprehensive irmaa guide, i’ll guide you through the fundamental changes, income thresholds, and strategies to navigate the 2025 irmaa landscape.

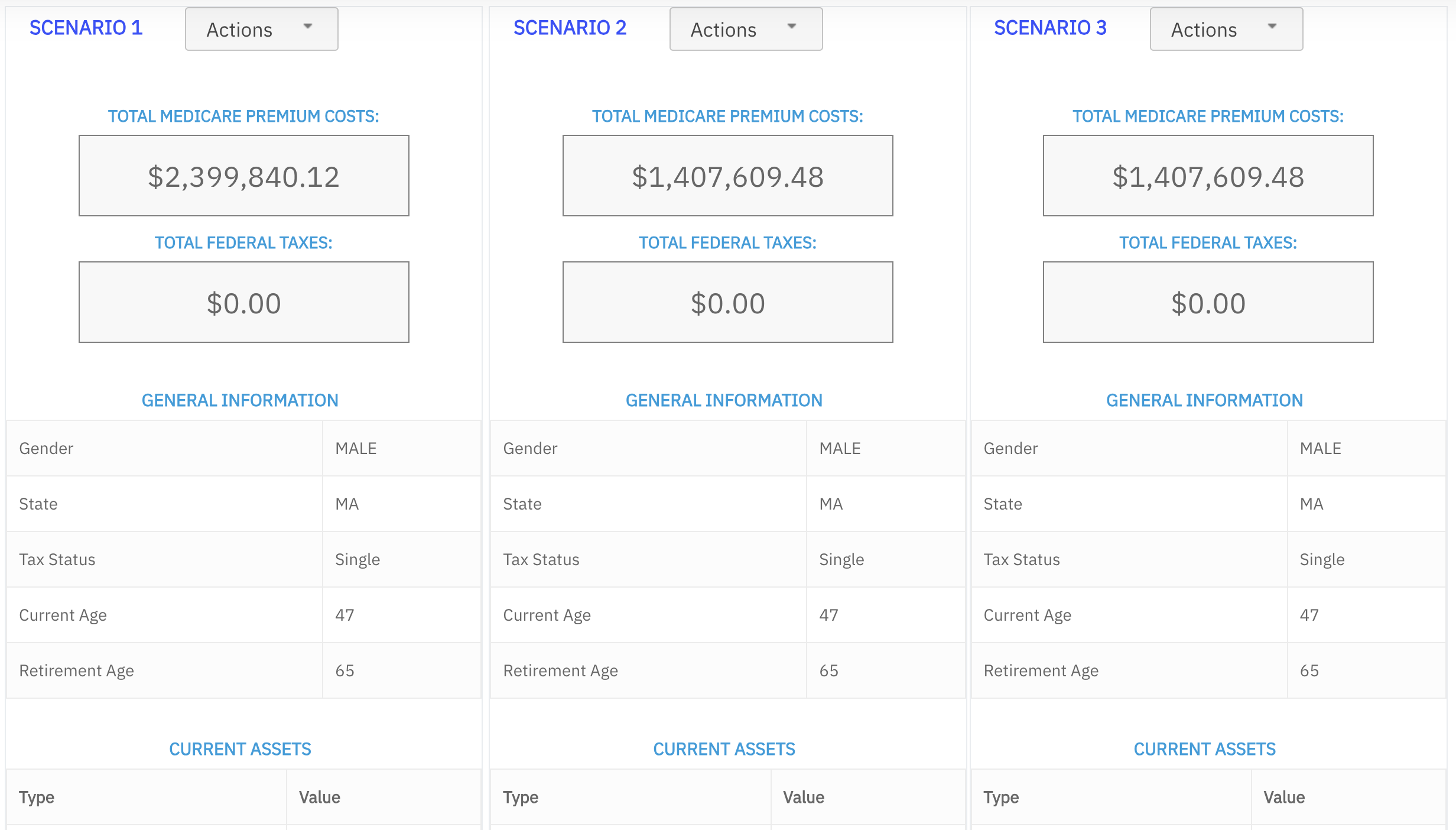

Irmaa 2025 Medicare Rates Brackets Dorie Geralda, Essentially, irmaa is a way of increasing the medicare part b and now part d payments drawn from your monthly social security checks.

Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, In 2025, if your 2025 income exceeds $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s part b and part.

Irmaa 2025 Medicare Rates Brackets Ssa Charla Enrichetta, Essentially, irmaa is a way of increasing the medicare part b and now part d payments drawn from your monthly social security checks.

Irmaa Rates For 2025 Dredi Ginelle, Single, head of household, married, filing separately (but living apart for the entire year) or surviving.

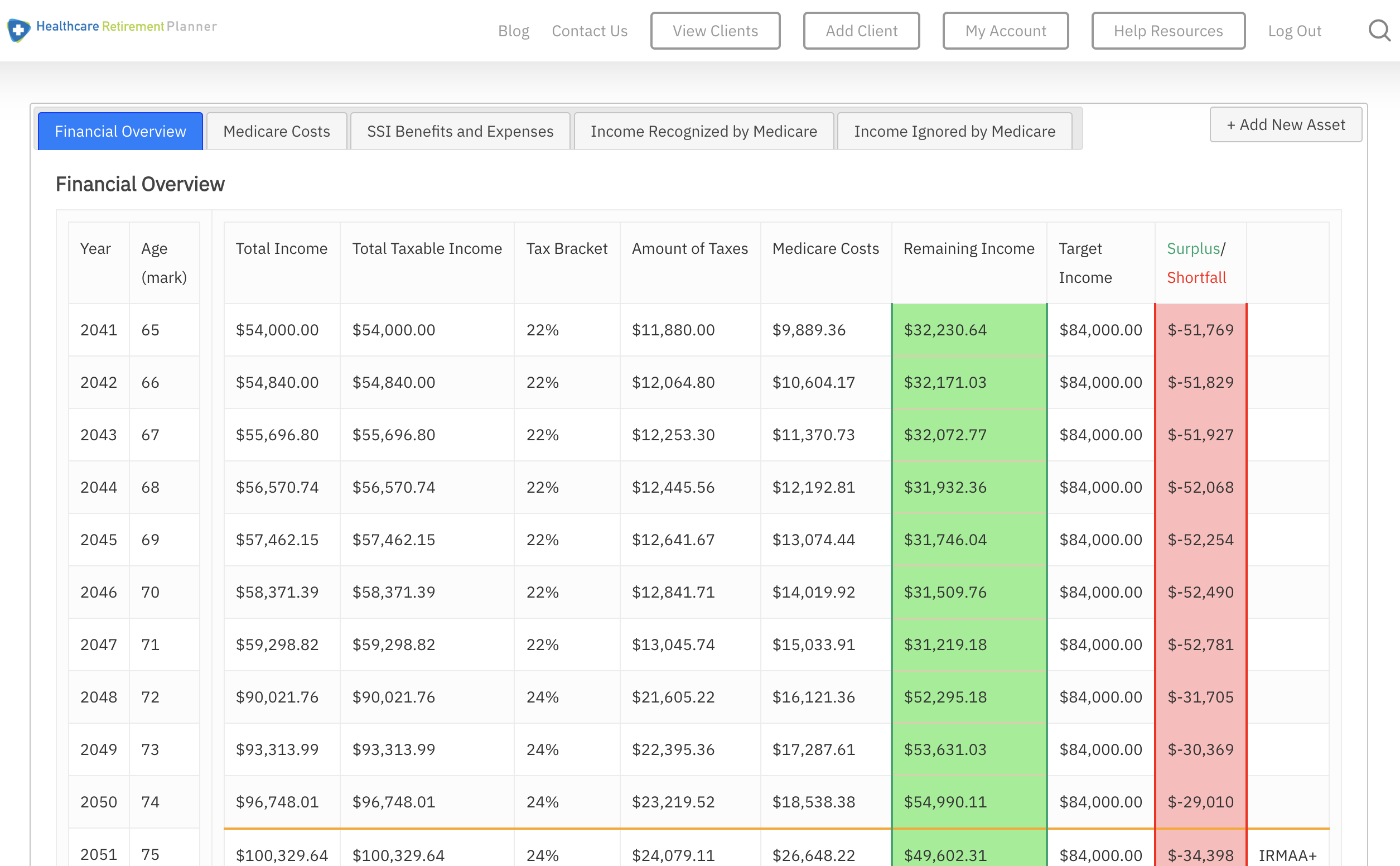

Irmaa 2025 Medicare Rates Brackets Ssa Jacki Letizia, Irmaa percentage tables, medicare part b premium year 2025 1.

What Are The Medicare Irmaa Rates For 2025 Amii Daloris, Irmaa rates for 2025 there are five irmaa income brackets depending on your income and filing status.

Your Guide to 2025 Medicare Part A and Part B BBI, For example, you would qualify for irmaa in 2025 if your magi from your 2025 tax returns meets the 2025 income thresholds ($103,000 for beneficiaries who file individual tax returns and.

Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, What are the 2025 irmaa brackets?

Irmaa 2025 Medicare Rates Brackets Correy Olivie, In 2025, if your 2025 income exceeded $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s.